We all have expenses. It could be utility bills, daily household spending, paying the mortgage, school fees, and other daily expenditures. If you are a working professional or even a homemaker, it is quite a challenge to manage all your expenses effectively.

Hence, I wrote this article to tell you how you can manage all your expenses very easily. If you read and implement the ideas given in this article, then I am quite sure you could not only track your expenses but also do it effectively without spending much of your time.

Moreover, you do not need any accountant or financial consultant to take care of your expenses. You save a lot of money by taking the right steps.

So here are a few simple ways to track your expenses:

10 Best Ways To Track Expenses

1. Track Your Daily, Weekly, and Monthly Expenditures

First, create an excel spreadsheet on your mobile phone or laptop. You need to track all your expenses. It really doesn’t matter how less you spend. You got to track your daily, weekly, and monthly expenses. If you don’t, then you will never know how much you are spending every year.

Hence, create a column in excel for daily, weekly and monthly expenses, add dates and items, and list them one by one in the cell.

2. Create a Household Gross Budget for Every Month and Year

After you have created an excel spreadsheet for tracking your daily budget, now it is time to create an estimated budget for your household. The budget that you create for a month would be an estimate. It means you will be spending this much amount of money every year, plus or minus.

If your budget is $3000 a month for various things like food, grocery, transportation, bills, etc, then you must try to meet that fixed budget every month.

3. Create a Separate Budget for all Your Savings

Now you have created an approx budget for your month. Now you have to have a separate budget for your savings. If you earn $5000 per month and spend $3000 on the mortgage to grocery, then your savings is around $2000.

Later on, you have to spend $2000 for various purposes like paying insurance, healthcare, and other unforeseen things.

So always track your savings also.

4. Pay All Your Bills on Time and Avoid Extra Charges

Paying bills should be your first priority before food items and other groceries. Other things could wait, but bills cannot. Always pay your bills on time to avoid penalties or extra charges.

Electricity bill, water bill, phone, internet, etc. you should pay on time.

5. Pay Close Attention to Credit Report

A credit report is very important for your financial freedom. Today much of your credibility depends upon credit ratings. Hence, always pay close attention to your credit report. You can get a free credit report once a year at www.annualcreditreport.com.

Check it whether the report is accurate or not. If you find any mistake or anomaly, then always raise a voice against the relevant authority.

6. Get Your Credit Score As Soon As Possible

The best way to track your budget or expenses is by obtaining your credit score. A Credit score helps you to understand how well you are performing financially.

Your three-digit credit score tells everything about your financial background. If your credit score is positive, like between 600 and 800 or even above 800, then you have a great future.

If your credit score is bad then you should start saving money and tracking all your expenses. Hence, getting a credit score is very important.

Also Read: How to Improve Credit Score

7. Clear All Your Credit Card Debt

Managing and tracking expenses would mean clearing all your credit card debt. You got to save money and clear all your credit card debt as soon as possible.

Do not live beyond your means. Spend only when you can pay it back. You could definitely improve your credit rating by managing and tracking all your expenses.

8. Examine Your Insurance Policy

If you have health insurance or life insurance, then you have to pay premiums every month. Your premiums could be more than your entire grocery expenditure.

Hence, you have to track all your insurance money separately. You have to create plans for how you are going to pay all your premiums without affecting your savings.

Therefore, creating, managing, and tracking your expenses is very important.

9. Show the Payment You Have Made While Purchasing Something

Another best way to save some money is through taxes. You know tax rates are very high, and you can save money on taxes if you spend your money wisely.

The first rule is always to pay money through a banking channel. If you shop, then never pay cash. Either use your credit card or just pay a cross-check. Never give cash, if do this, then you save a lot of money on taxes every year.

These small things could help you save a lot of money.

10. Consult a Financial Planner or an Accountant

Finally, if you are really not able to track your income on your own because your expenditures are so huge, then you could consult a financial planner or an accountant. However, hiring a financial planner is only possible when your income is very high, and you cannot do it on your own.

So these are some tips to track your expenses humanely. However, you could also take the help of technology.

There are hundreds of small and big apps that could help you track your expenses. You don’t have to waste time using these apps.

Let us look at some of the apps that can help you track your daily and monthly expenses easily.

Best Money Tracking Apps

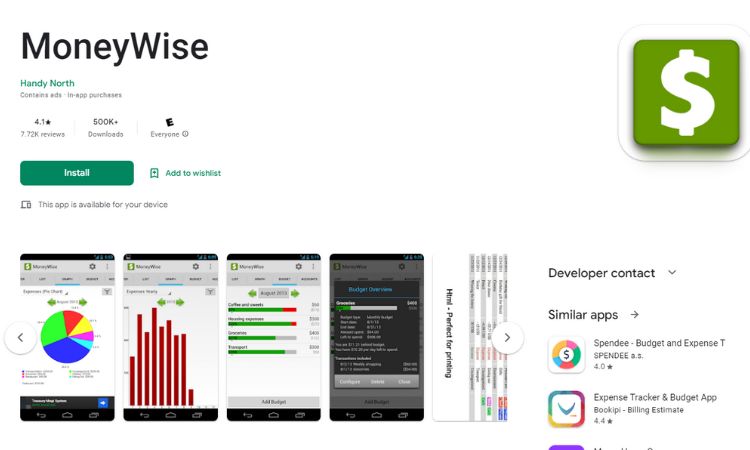

1. MoneyWise

The first app that could help you track and manage your expenses would be MoneyWise. MoneyWise could help you understand all your financial standings.

The most useful feature is the graph section, which highlights one section of data against another. Tags are another feature that makes this app cool.

You could select records that you would like to compare against another record. It also helps you to project your future expenses and how you can save money.

The app is available for free and Pro Version also.

2. Financisto – Expense Manager

The second app is our list is Financisto – Expense Manager. This app includes a lot of shortcuts, menus, or icons. This really makes the interface very easy to understand and use. The “New Transaction” widget is the most prominent feature.

It will show a table where you can fill in all your data in the current transaction table. There is also a shortcut called “New Transfer”. It lets you transfer your money from one account to another.

The blotter is another feature that records your every single transaction under one page. This app is totally free, and there is no paid version.

3. Easy Money

EasyMoney is a rich user interface app. It has an inbuilt custom keyboard for users to type in numbers for any transactions. You could send notifications for upcoming bills and even color code all financial details.

You can also do split transactions. Easy Money is available for 30 days free trial period. For the pro version, you have to pay $9.95.

4. AndroMoney Expense Track Money

The third app is AndroMoney. It is for android devices and laptops or PC. You can export your data to a CSV file and access via MS Excel or Google Drive also.

You can instantly audit your account on any web browser once you log into your Google Doc account. It is available in free and paid versions. The paid version is just $2.99

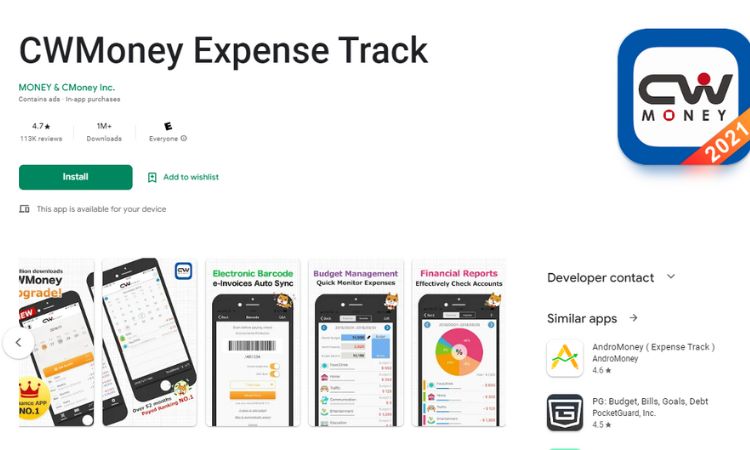

5. CW Money Expense Track

CW Money Expense Tracker uses speed recognition technology. You have simple pages for expenses, Income, Data Manager, and reports.

You can save your transaction and proceed to the next record easily. The pro version of the ad would cost you around $4.99

6. Cash, CoinKeeper, Colorful Budget, etc

All these three are helpful in tracking your budget and other expenses.

- Cash – Categories and Subcategories are given as soon as you open the app.

- CoinKeeper – You can drag icons into categories and create new transactions. There is also an automatic budget planner.

- Colorful Budget – Colorful categories and pie charts help you understand your expenditure better.

Conclusion:

Tracking expenses is an important part of any budget. By understanding where your money goes, you can make informed decisions for the future and become more financially secure. You have seen how you can track your expenses manually and if you find it difficult, then you could also take the help of technology. The list of the best money tracking apps provided in this article will help you choose the one that fits your particular needs best.

He began his journey with affiliate marketing in 2004 and has since built multiple 7-figure online businesses through blogging, SEO, and automation.

With over 14 years of experience in content and more than 3 years specializing in AI automations and AI agents, Pritam now helps businesses and solopreneurs automate their operations, generate leads, and scale effortlessly using AI-powered systems.

Through his training and tutorials, he has empowered thousands to turn automation into income — making him a trusted voice in India’s growing AI and automation space.