For most Americans, buying a house is one of the biggest investments they make during their lifetime. That’s right. I use the word investment because a house isn’t simply a home or a mere dwelling place.

Over the years, its value in the real estate market has kept rising. This means you can sell the house and make a profit anytime while saving money while buying another.

The popular way of buying a house in the USA is by taking a mortgage. As most of us would know, the mortgage amount directly depends on our income and several other factors.

However, how much money we make in a year plays the most important role. Simply because it’s impossible to get a mortgage if we’re earning too less and can’t afford a house, and if we’re earning more, a mortgage wouldn’t be necessary since it would be possible to pay fully for the house.

However, there’re other calculations that also play a role in deciding the mortgage amount. In this article, I will discuss about If I make 70000 a year, how much house can I afford?

I’ll start by giving you some facts and figures that would help you understand how mortgages work and how much worth house you could afford.

Facts & Figures of Housing in the USA

Let’s start by looking at the costs of housing in the USA. Because this directly affects how much worth a house you can buy if you’re making $70,000 a year.

By early 2022, the cost of housing in the USA has risen by some 73 per cent, in comparison with the year 2000, according to a report by CNBC news. This report quotes a study by RenoFi, a home renovations loan provider in the USA.

According to US Census Bureau, home ownership in the US stands at about 65.5 per cent, considering figures 2022. There was a slight drop in ownership rates during the ongoing Covid-19 pandemic in 2024 and 2020. However, the rate of housing or buying houses on a mortgage is picking up, the Census Bureau report states.

These factors directly affect home ownership, regardless of your yearly salary. Now, let’s see how much a house you can afford with a salary of $70,000 per year.

I Make $70,000 a Year How Much House Can I Afford?

Now, moving forward to answer the question, how much house I can afford if I make $70,000 a year. Here’re some answers that would help you as well as others who earn lesser or more than this amount.

I will respond with simple steps so that you can easily understand and know how much worth a house you can afford.

1. Average Salaries in the USA

The average salary in the USA stood at $51,168 in 2024, says a report compiled by Indeed.com, one of the biggest job boards in the world. This salary is higher by 5.1 per cent compared to 2019.

The average salary was calculated on the basis of those in various US states drawn by an estimated 111.5 million persons working 52 weeks a year. While in some states, the salary could be higher than this amount, in some, it can be lower too.

2. Maximum Amount of Salary for Mortgage

A maximum of 43 per cent of your salary can be paid towards the mortgage, according to the rules of the Consumer Finance Protection Bureau. This means that if you’re earning $70,000 a year, you can pay a maximum of $30,100 per year for your mortgage. This leaves you with $39,900 per year for household expenses.

All these amounts are before taxes. This means you’ll have to deduct the amount of taxes you’re paying every year from the $70,000 income to arrive at the exact figure. Understandably, this would be lesser than the amounts that I mentioned above.

Read: Renting Vs. Buying a House

3. Inflation and Impact

Obviously, your income is necessary for living a proper life. This means expenses on food, clothing, entertainment, education for kids, gasoline, water, power, Internet and lots of other things.

These don’t come free. As a matter of fact, the cost of a lot of stuff in America is always on the rise due to some or other reason.

Before you calculate how much worth a house you can own or buy, consider the yearly inflation. Because inflation directly affects your buying power. Also, take into consideration something that’s commonly known as Time Value of Money or TVM.

According to TVM calculations, the buying power of your money drops by an average of 4.5 per cent every year. This means the $100 that you have today will be worth only $96.50 after a year.

4. Credit Score

I’m sure that most Americans are aware of this. Your credit score or credit ratings also decide on how much worth a house you can buy on the mortgage.

You can get a free credit score on Experian or other such websites. Generally, lenders that give mortgages will always check your credit score before parting with their money. That’s because they wish to make sure that you will pay your mortgage on time.

Here, I’ll break a common myth. Having a poor credit score doesn’t actually affect or prevent you from getting a mortgage. Some lenders will give you the money to buy a house.

However, the amount could be smaller, or the interest rates could be higher to cover additional expenses. These expenses are insurance that covers your mortgage. If you default, the lender can always claim the full money from an insurer, but you lose the home to foreclosure.

5. Insurance and Social Security

Another expense from your income of $70,000 would be insurance costs and Social Security contributions. We need to take into account health plans, vehicle insurance as well as homeowner’s insurance. These are unavoidable costs and will take away some money from your salary.

Therefore, while calculating how much worth a house you should buy or the amount of mortgage you could get, deduct these amounts too. That’s because some financial institutions that give mortgages will lower your income ratings according to these expenses. Therefore, it’s better that you calculate these figures yourself and arrive at how much mortgage you can get.

6. Joint Borrower

So far, we’re discussing a single salary of $70,000 a year. Now, let’s consider situations where you have a joint borrower. This joint borrower could be your parent or spouse. In such cases, the amount of mortgage you can get rises automatically.

If your spouse, parent, or any joint borrower gets, let’s say, $30,000 per year before taxes as salary, you can use the same formulas to calculate the amount of mortgage. That means you can pay up to $43,000 per year as a mortgage. This qualifies you to buy a pricier house. Apply the same deductions for taxes and other expenses.

7. Age of the Main Borrower

This is something you should know about. Home mortgage companies also consider your age at the time of application. Therefore, you can get a better interest rate and higher mortgage if you’re applying while young. This also holds true if you and your spouse are young and applying jointly for the mortgage.

Though age isn’t really a rule, some lenders believe that younger people are less prone to default. That’s because they would remain in employment for longer and hence, be in a position to pay their mortgage on time. As a matter of fact, you could look around the mortgage market to find if there’re any special rates or higher mortgages available from certain providers.

8. Age of the Property

Though this isn’t really significant, the age of the house you’re planning on buying could, in some cases, affect the amount of mortgage that you can get. That’s because some properties might require renovation and repairs, though they’re available very cheap. The cost of repairs and renovation can sometimes cost more than the house price itself.

In such cases, the best idea would be to get a quote from any mortgage company. And once you have the quote, it’s worth finding how much you would spend on repairs.

That’s because the mortgage company usually won’t pay for these renovations and repairs. You might require another loan to cover these expenses, from a totally different provider.

9. Downpayment

All this while, you would have wondered about the downpayment on houses. In the US, it is customary to pay 20 per cent of the actual cost of the house while the mortgage will cover 90 per cent. This means that if you’re buying a house worth $300,000, you require at least $30,000 on hand for the downpayment.

Mortgage companies ask for proof that you have the 20 per cent downpayment money ready. They could ask you for bank statements or other documents as proof while applying for a mortgage.

There’s no point in spending your entire savings by offering a higher downpayment, as some real estate companies advise. The US government’s Department of Housing and Urban Development also provides money for a downpayment for a house to eligible citizens.

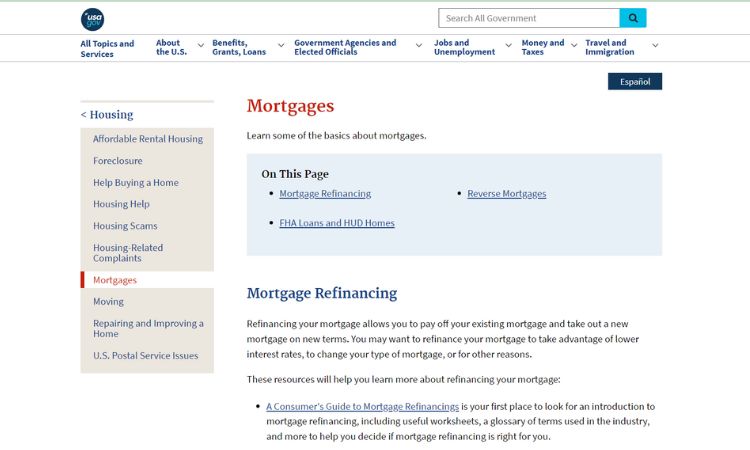

10. Government Mortgages

Visit this website of the US government that gives a lot of information about inexpensive mortgage plans for all American citizens. A mortgage from the US government could help you buy a bigger and better house with a yearly pay of $70,000.

Additionally, certain US states also have their own programs and plans that offer mortgages at lower than market rates to citizens. You could check the state-wise availability, terms and conditions to qualify for these mortgages from this link. These could help save a lot of money that you would otherwise have to pay as interest.

Also Read: Best Ways For Making Money In Real Estate

11. Relocation Costs

Often, lots of people move to other cities because they’re looking for cheaper housing or even free land from the government to build a house. If you’re among such people, consider your relocation costs while calculating the overall cost of the house. That’s because relocation costs can be very high in some cases, and you would have to dig out money from savings for this purpose.

There’re lots of USA states that offer free or even cheap land to eligible citizens. However, such free or cheap land often comes with a load of terms and conditions.

In most cases, you would have to build a house of a specific size within six months of getting a lot of land from the government. However, these plans and programs could help build a bigger house for a $70,000 salary every year.

12. Loans and More

Some 44 million students in the USA owe banks and other lenders a whopping $1.6 trillion collectively. That’s because of unpaid student loans. If you’re unable to pay or clear a student loan, the mortgage you get would be directly affected. That’s because student loans also impact your credit score.

Americans also owe $856 billion to banks and other lenders as credit card debt, according to reports. On average, an American household owes about $6,150 as unpaid credit card debt to lenders. These factors also affect the value of the mortgage that you can get.

Calculating Final Costs

So, how much house can you afford for $70,000 a year? The calculations are very simple if you use these yardsticks that I mention above. It’s worth knowing that each mortgage company has its own internal systems to qualify or disqualify an applicant for the mortgage.

That depends on a lot of factors, including some that I mention above.

Therefore, the best thing to do is search online for various options of mortgages available and compare them. Also, read the terms and conditions for each mortgage company. Knowing them is better because the real estate agency could ask for details of the company where you’re taking the mortgage.

Closing Thoughts

Before concluding, I’ll add that owning a house is a recurring expense. You’ll have to pay homeowners tax and other dues to the local and state admins. Some experts in the housing industry believe that we shouldn’t buy a house that costs more than three times our annual income.

In this case, if the income per year is $70,000, the cost of the house would be $210,000. However, with real estate prices on the rise, it’s doubtful you can get anything worthwhile for this amount of money.

Samuel Mitchell is a financial analyst with expertise in investment research and risk assessment. With a background in finance and advanced certifications, he delivers accurate and concise financial analysis. Samuel’s writing style is precise and data-driven, providing actionable insights for readers. Explore the world of finance with him and make informed investment decisions.