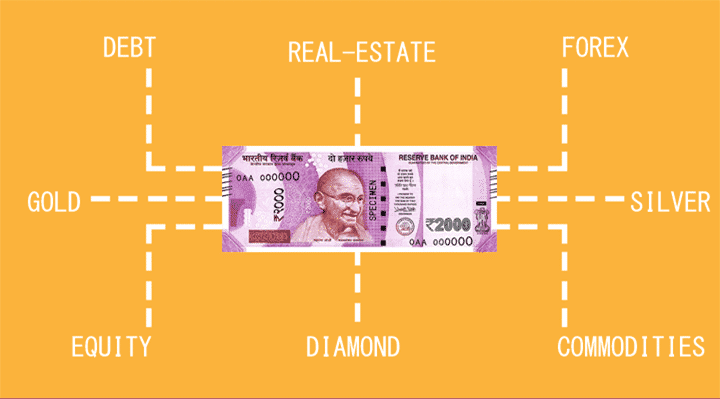

Let’s consider you’ve Rs. 1 Lakh and more to invest and would like the best possible returns; where would you put the money? There’re countless schemes and investment options that are readily available nowadays.

However, investing isn’t child’s play or a cakewalk, as you might imagine. If you don’t invest the money properly, chances are you’ll end up saving nothing. Why’s that? Because of a factor that everyday investors like you and I are unaware of.

And this factor is known as the Time Value of Money.

Understanding the Time Value of Money

Maybe you’ve heard the term Time Value of Money or TVM for the first time. Or you’re unaware of how it works with your money. Therefore, I’ll explain briefly in simple words.

Let’s consider you deposit Rs.100 in your savings bank account and maintain the amount for a full financial year, from April 1 to March 31. The bank will pay you an interest of Rs.4.50 or four-and-half percent. This means your bank balance at the end of a financial year would stand at Rs.104.50.

The figure can vary slightly depending upon the type of bank where you hold the account and prevailing interest rates. Generally, 4.5 percent is taken as the standard interest rate worldwide.

Now let’s consider you don’t keep the Rs.100 in a savings bank account. Instead, you keep it at home. At the end of the year, that Rs.100 will be worth only Rs.95.50. That’s because, over a period of time, the value of money goes down. Whatever stuff you could buy for Rs.100 a year ago will now cost Rs.104.50. This means you’re paying more for the purchase now.

Since the value of money drops by about 4.5 percent every year, your Rs.100 today will be much lesser over a period of years till it loses value altogether.

Avoiding Losses from the Time Value of Money

There’s only one way to avoid losses to your money due to TVM. And that’s by investing money in a manner that fetches you the highest possible returns.

Actually, beating TVM is like playing a cat-and-mouse game. You need to invest your money in a manner that not only helps you overcome the drop in monetary value but also helps to gain something extra. That means, your Rs.100 shouldn’t be worth only Rs.104.50. It should be much higher.

If you invest Rs.1 Lakh or higher wisely, it’s possible to overcome these losses due to a drop in money value. And in this article, I’ll show you 10 different ways to invest your money for better returns.

15 Best Investment Options for Higher Returns

There’s one major factor to consider before investing your money for higher returns. And that’s your current age and the time for which you wish to remain invested. The longer you invest, the higher is returns, is a myth. In fact, investing in the wrong schemes won’t help you circumvent TVM and drop in money value.

Therefore, consider these ten ways.

1. Invest Money in Debt

It is the safest investment option, and preferred debt instruments are FDs of Nationalized Banks, Post Offices, Government Bonds, etc.

Let us see how they operate, function, pay us the interest regularly, and return our principles in time. They borrow from us at low rates and lend it at higher rates to small and big businesses, corporations, and development projects.

The majority of these borrowers, entrepreneurs, and companies, actually perform well, pay interest, and repay loans-principals to banks and still make a profit for themselves. That is why all Nationalized Banks, Post Offices, Pay us Interest Regularly and repay our principals without fail and still make a profit.

Actually, our so called Safest Investment Income-Interest paid by Nationalized Banks, Post Offices, is thus created by these borrowers, companies, & entrepreneurs, who fulfill some social, economic, technical, and practical, needs of mankind efficiently and effectively.

Thus, wealth is created by some kind of entrepreneurship only which adds value for the betterment of society at large. Moreover, entrepreneurship creates value by bringing together two needy groups – lenders, the people, and borrowers the entrepreneurs, and businessmen.

Banks also finance housing and help customers-home buyers in creating an important asset for them. Banks also widen and make faster customer reach by financing vehicles for them.

Right from the dawn of civilization anywhere and everywhere, we see that entrepreneurship alone has bettered human lives by innovating, inventing right from fire, wheels, levers, farming to planes, and robots, and so on, and adding value for the betterment of society at large.

So, debt is a secure investment option. It is when you don’t want to take any risk and want a moderate return on your investment you choose debt. It is not the best investment plan.

Let us move further to more investment options.

2. Gold Investment Plan

Gold is a precious metal. But, It remains stagnant, static and it is a static passive asset. 100 grams of gold does not increase to 105 grams nor decrease to 95 grams. Nor does its purity changes from 22 Carat to 24 Carat or vice versa.

It does not grow or change quantitatively or qualitatively. So, investing in Gold is nothing but a mere commodity than an asset or investment option.

Price fluctuations in these assets are solely due to the forces of demand and supply and not due to any change in their intrinsic value.

But, Gold though a static passive asset is a special commodity because of all its qualities, beauty, indestructibility, condensed value, universal acceptance, liquidity, and so on.

A jeweler adds value to gold by making beautiful ornaments and sells them at a profit. But, the same jewelry loses value when brought back for resale.

It has been observed normally that Gold prices shoot up when there is a recession; stocks are stumbling, uncertainty, lack of confidence, and vice-versa.

Statistics regarding Gold prices over the last 400 years have established that Gold has always preserved purchasing power but has given very little real Returns. Exceptional Returns in patches have been nullified by low or negative returns at other times.

So, Gold also is not the best investment option, rather it is a commodity and static passive asset. Returns are also uncertain.

3. Multibagger Stocks

Stocks are by far the best way to invest your money for better returns. In fact, countless people across India indulge in inter-day and intra-day trading on the stock market to make money daily. You can make a minimum of Rs.1,000 per day with inter-day and intra-day trading once you get astute knowledge of the stock market, for an investment of Rs.1 Lakh and higher.

If you study the workings of a stock market and the performance of certain stocks, you’ll find they fetch the highest returns. These are known as Multibagger Stocks. Refer to any good list of Multibagger stocks and focus on five to six of these after reading reviews in financial dailies. Invest in those and trade daily for better returns.

Also Read: How To Buy Stocks Online

4. Mutual Funds

Mutual Funds (MFs) provide an excellent opportunity to invest your money for better returns. However, you’ll need to know which MFs are best to put your money. The first thing while investing in MFs is to avoid brokers and distributors.

There’re four options- Regular-Growth, Regular-Dividend, Direct- Growth and Direct-Dividend. Among these, I suggest Direct-Growth. That’s because you don’t pay commissions to distributors but buy online directly from the Mutual Fund house.

And Growth Plan because the Mutual Fund House will credit more units to your account worth the dividend you would get as cash. Money invested on MFs in Direct-Growth plans offer the highest returns.

If you’re willing to take high risks, invest your Rs.100,000 in equity-based Fund of Funds (FoFs) that invest in foreign markets. This means you would be investing indirectly in stocks at the New York Stock Exchange and other global bourses. Returns on investment can go as high as 25 percent within a year. MFs based on equities in India can fetch you up to 18 percent returns per annum and carry moderately high risk.

Debt MFs are moderate risk and will offer you about eight to nine percent return on investment, while Hybrid MFs are a mix of debt and equity. They provide up to 12 percent returns per annum. The lowest risks are Liquid MFs which will provide six to eight percent returns over a year.

5. Sovereign Gold Bonds

Reserve Bank of India, on behalf of the Indian government, issues Sovereign Gold Bonds or SGBs three to four times every year, depending on how well the national economy fares. Each SGB is worth one gram of physical gold. And SGBs are usually sold much below the prevailing market rate of one gram 24 carat or pure gold.

The Indian government and banks also offer an additional discount of Rs.25 to Rs.50 when you buy SGBs online and hold them in dematerialized format.

Generally, the Indian government offers a flat interest of Rs.200 to Rs.250 every six months on every SGB. There’s a lock-in period of five years for redeeming an SGB. And you can redeem your SGB after a period of eight years. RBI will pay you the market rate of 24-carat gold prevailing at the time, which is usually much higher than what you’ve invested.

In mid-2021, the average price of an SGB stood around Rs.4,000. Meaning, you can hold at least 25 SGBs by investing your Rs.1 Lakh and higher. This means you’ll get Rs.10,000 per year as interest every year and also benefit from the market rate of gold after eight years when you redeem the bond. And if needed, you can sell your SGBs through your Dematerialized or Demat and Trading account to get cash within two working days.

6. Exchange Traded Funds

For some reason, Exchange Traded Funds or ETFs aren’t that popular among most investors. That’s because they don’t know what ETFs are and their benefits. Briefly, an ETF is a form of Mutual Fund. It’s a basket of stocks.

And like stocks, ETFs also trade daily on stock exchanges. Therefore, you can buy ETFs directly from an Asset Management Company (AMC) when it comes up with a New Fund Offer or Further Funds Offer. Or you can buy them directly from your Dematerialized (Demat and Trading account).

ETFs allow you to invest in diverse sectors without buying individual stocks of individual companies. For example, we have ETFs that consist of 50 topmost midcap companies or 25 blue-chip companies, gold, and other commodities. Their rates also fluctuate daily.

If you require money urgently, it’s possible to sell all or some of your ETFs on the stock market during trading hours. You get the money within two working days. ETFs can fetch you annual returns of up to 20 percent if you select the right ones or buy during NFO and FFO periods.

7. Bank Fixed Deposits

Fixed Deposits have always been a favorite of the Indian investor. That’s because they provide between seven and 9.5 percent annual compounded interest depending upon the bank and your age.

For example, the latest genre of financial institutions, known as Small Finance Banks, offers up to 9.25 percent for male senior citizens and 9.50 percent for women over 60 years of age. For others, the rate of interest is about seven percent, with cooperative banks and India Post Payments Bank paying a little more.

Invest your money on an FD to get better returns if you’re looking for something that doesn’t involve any apparent risks. However, be extra cautious while selecting the bank. Through cooperative banks provide half a percent more interest, some of them have crashed since 2019 leaving ordinary investors in the dark over the fate of their hard-earned income.

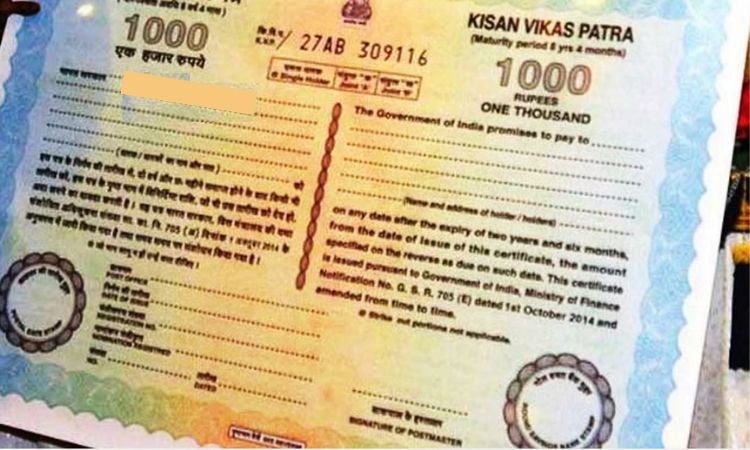

8. Kisan Vikas Patra

If you’re younger and looking to double your money by investing a minimum1 Lakh, then Kisan Vikas Patra or KVP is the best investment plan. This is a Central government-sponsored fixed deposit scheme that has a fixed maturity of 124 months.

It fetches 6.9 percent compounded interest annually. Meaning the Rs.100,000 you invest fetches you Rs.200,000 after ten years and four months. You can buy KVPs in multiples of Rs.100 and Rs.1,000 each.

You can apply for KVP from any India Post Payment Bank branch or post office that offers India Post financial services. KVPs are extremely safe and are also useful as collateral while taking loans from banks or Non-Banking Financial Companies (NBFCs). However, there’re no Income Tax exemptions for investing in KVPs.

9. National Savings Certificate

The Indian government also issues National Savings Certificates or NSC through India Post Payments Bank. These are available in denominations of Rs.100 and Rs.1,000 each. These are also ideal for working people since they entitle you to an exemption from Income Tax under Section 80-C.

The minimum holding period of NSC is five years. You get 6.8 percent compounded interest every year. An investment of Rs.1,000 will fetch you Rs.1,389.49 after a period of five years. This translates as Rs.38,949 interest on your investment of Rs.100,000 after five years. You can apply for NSCs at any India Post Payments Bank branch or an India Post branch that offers financial services.

10. National Pension Scheme

Want to invest for your retirement? Invest your money in the National Pension Scheme sponsored by the Pension Fund Regulatory & Development Authority of India (PFRDA). However, the only flipside is that you’ll have to contribute Rs.100,000 every year till retirement or keep the money in a savings account to pay for your monthly NPS contributions.

Despite these flipsides, I would still recommend NPS as the best investment option for the highest returns. That’s because you get to invest in two different pension plans- Tier-1 and Tier-2. If you desire, you can select two different pension plans for each tier. And upon retirement, the money goes into annuities. This means you get a handsome monthly pension upon reaching 60 years of age.

11. Commodities

Similar to stock trading, it’s also possible to invest your money for higher returns on the Multi-Commodities Exchange or MCX. Actually, commodities are stuff such as gold, silver, copper, lead, and other precious and semi-precious metals. And of course, the most precious commodity, crude oil as well.

These commodities trade on a daily basis. Prices depend upon upswings and downturns in the global market. Commodity trading has helped countless people worldwide to become millionaires.

You can trade in commodities with some knowledge about the market and trading price history. And by learning from a few online tutorials that are available free or for a small cost. Unlike stock trading, which occurs only when stock markets are open, commodity trading is around the clock. Therefore, you need to be extra alert on what to buy, hold or sell to make big money.

12. Investing in Art

I’m not suggesting you attend an auction at Sotheby’s or Christie’s to buy a Michelangelo or Picasso painting. With a mere Rs.1 Lakh, you won’t get anything near that. However, you can invest in art from budding artists whose paintings and sculptures or other works of art are already in demand.

Visit some art galleries in your city and attend a few art exhibitions. You can also learn how to invest in art from various online resources. Actually, you can buy a few pieces of art by investing your Rs.100,000. And for the highest returns, sell the art at auctions or to individual collectors at your price. Investing in art is the latest trend worldwide, and now’s the right time to put your money.

13. Diamonds as Investment Option

Diamond is one of the most expensive crystals in the world. In India, a one-carat average Diamond costs around Rs. 3 Lakhs (whereas a 3-carat Diamond was costing Rs. 50 Lakhs.

Its extremely condensed value and portability bestow Diamond as a form of emergency funding for the dictators, Rulers, and Super rich on a panic flight.

Like Gold, Diamond is also a commodity. It remains stagnant, static. It is a static passive asset. If you buy a 2 Carat diamond and keep it for 20 days or 20 years, it does not grow to 3 Carat, nor does the number 1 diamond become the number 2 diamond.

It has no fungibility. Being brittle, it could be easily scratched or damaged. Therefore, difficult to maintain. A large number of variables in quality makes pricing difficult, and subjective. Hence, no loan is given against Diamond as security.

Because of all this no terminal market for Diamonds, resulting in no liquidity.

So, Diamonds are not at all an investment option for anybody. You can buy a diamond and it may be used to show-off of possessing an expensive gem.

14. Real Estate (R.E.) Investment

People say, real estate is the best and safest investment option, is it?

Real Estate rather is a high investment option. You can invest your money in plots, flats, bungalows, shops, and other types of properties. You can find investment options from Rs 1 lakh to Rs. 1 Crore depending upon the size, location, and type of property.

Further, transactions of R.E. are always risky because of problems in title disputes. There are many frauds noticed. Transaction cost is also high, i.e., around 10% of the cost. R.E. has very little liquidity. You can sell 1 ton of Gold worth Rs. 300 Crores & realize the money in a couple of days.

But, when you are in dire need, you may not get even ¾ th the price of a single bedroom flat in a whole year.

You need thorough knowledge, a lot of Experience, perspective & lots of money to buy the right type of R.E. at the right place at the right time & price. Over and above, this one needs holding power of 5 years to 10 years to make R.E. investment safe & profitable.

This is not an easy proposition for most of us. Like a stock market or Gold market, there is no market as such for R.E. where proper price discovery takes place.

Real estate is also a static and passive asset. A 1000 Sq.ft. Flat, 10,000 Sq.ft. Plot, or 10-acre farmland change or grow automatically even if held for 20 days or 20 years.

Real estate is also a very special static passive asset that has very important essential uses in every sphere of our lives. Owning a house is a lifelong ambition matter of sentimental- emotional satisfaction for almost everyone.

Of course, R.E. is tangible in a real sense and has some important uses like constructing your home, houses, school, colleges, factories, roads, shopping malls, offices, and so on. Thus, entrepreneurship can add great value to it.

You have to consider all the above circumstances before investing in Real Estate. Real estate is also not the best investment option. Keep your curiosity on before we move on to more investment options.

Also Read:

- Best Ways for Making Money in Real Estate

- Ways to Invest in Real Estate without Actually Buying a House

- Top Real Estate Websites in India for Property Search

15. Equity Investment

Buying a share of a company means buying the smallest unit of ownership in a company or an enterprise. Out of the more than 5000 Companies which are listed on BSE and NSE, there are many good companies growing at a Compounded Annual Growth Rate (CAGR) of more than 18 %.

This means their Net Profits (N.P.), Earning per Share (EPS) are becoming double in every 3 to 4 years. Consequently, their book values (B.V.) and real worth are also growing & doubling every 3 to 4 years.

Let us take some examples of companies that have given outstanding returns.

For example, Infosys is a software giant. If you had invested Rs. 1,00,000/- in Infosys (INFI) IPO in 1993, your shares would have a value of Rs. 30 Crores now. i.e., 3000 times increase. This tremendous growth in shareholding works out to be at a CAGR of more than 40 % means the stock doubled in value every 1.80 years.

IPCA Labs grew at more than 17 percent Compounded Annual Growth Rate (CAGR) from 2009-10 and 2013-14. Its Earning Per Share (EPS) of Face Value of Rs. 2 grew more than two times from Rs. 16.75 in 2009-10 to Rs. 37.83 in 2024-14. Book Value (B.V.) also increased more than double from Rs. 69.86 in 2009-10 to Rs. 157 in 2024-14.

Net worth got doubled from Rs. 874 Crores in 2009-10 to Rs. 1980 Crores in 2024-14. Net profit (N.P.) also got doubled from Rs. 209 Crores in 2009-10 to Rs. 477 Crores in 2024-14. The share capital was unchanged at Rs. 25 Cr.

This means that the intrinsic values of Infosys and IPCA shares got more than doubled during these respective periods around Compounded Annual Growth Rate (CAGR) of more than 18 percent. The true value, real worth of these shares increased, and doubled on their own in 3 to 4 years. There are always many such examples and companies.

This clearly shows that shares of good growing companies are always growing in real-intrinsic values-Earning Per Share, the book values. Hence, they are truly growing Active and Dynamic assets.

So, investment in good and growing equity is an investment in an active, growing, dynamic asset, always increasing in real value. When the true- intrinsic- real value of the asset is growing, the market value of the asset is bound to go up sooner than later.

All the assets except equity are like mere commodities. They can’t do anything on their own, remain stagnant and hence are static, passive assets.

Price fluctuations in these assets are solely due to the forces of demand and supply and not due to any change in their intrinsic value, real worth. These assets do not grow, or change, quantitatively or qualitatively.

They remain stagnant and static. These are static passive assets.

After peeping deep into the hearts and souls of all these assets, it is crystal clear that human entrepreneurship, dreams, and expertise, alone are always responsible for value addition and wealth creation in this world.

And from the point of view of investors amongst the top most human enterprises are the good corporate companies listed on B.S.E. and N.S.E. for the many advantages of investing in the listed companies.

We have seen that all the investment assets except equity cannot change or grow in their real-intrinsic values. Hence, all these assets except equity are stagnant, Static, Passive, and Assets.

To get any returns from these assets, you have to depend solely on the forces of demand and supply rather than any growth in their intrinsic value, which is impossible. Mere and total dependents on the forces of demand and supply for a price increase, returns are speculative, risky, and unscientific approaches.

It is crystal clear that human entrepreneurship alone has been and always will be responsible for the creation of all the wealth in this world.

The best avenue for investment in this good entrepreneurship is investing in good growing equity shares of good growing listed companies growing in real worth, and intrinsic value all the time, as seen in the examples of Infosys and IPCA LABS.

Hence, equity shares of good growing companies, growing all the time, in intrinsic value real worth alone, are Active, Dynamic, and Creative, Assets and hence undoubtedly the very best Investment Option and Asset Class.

In Conclusion

Remember, investments aren’t easy. You need to assess how much money your Rs. 1 Lakh will fetch over a period of years using the Time Value of Money formula and see how that matches with your financial goals for the future. These top 10 ways to invest your money in India should fetch better returns.

He began his journey with affiliate marketing in 2004 and has since built multiple 7-figure online businesses through blogging, SEO, and automation.

With over 14 years of experience in content and more than 3 years specializing in AI automations and AI agents, Pritam now helps businesses and solopreneurs automate their operations, generate leads, and scale effortlessly using AI-powered systems.

Through his training and tutorials, he has empowered thousands to turn automation into income — making him a trusted voice in India’s growing AI and automation space.