Have you ever dreamed of living in a country with no income tax? I mean, a country where you get the full salary and perks and don’t have to worry about tax deductions and payments?

Actually, there’re several such countries around the world. These countries don’t charge income tax from their citizens and residents. In this article, I will be writing about such countries.

If you wish to stop paying income tax altogether, it’s possible to find jobs and work in some of these countries.

Income Tax is Worldwide

The first thing you should know: income tax is charged by most countries around the world.

Most of us cough up lots of money as income tax. This money goes from our annual income. Of course, there’re several legit ways to save on annual income tax by investing the money on various plans approved by the Internal Revenue Service of the US or the tax authorities of your country.

Almost every government around the world levies income tax on its citizens and residents. In some countries, expatriate workers are exempt from income tax, while government staff and military personnel don’t have to pay such taxes in certain places.

Taxation laws vary according to each country. In some countries, there’s no income tax in any way. This means citizens and expatriates or permanent residents needn’t pay any income tax.

This brings a vital question to our minds. What does the government do with all the money that it takes from people, are income tax? Is there any need to levy income tax at all when governments have several other sources of income?

I will begin by explaining why countries and their governments levy income tax on persons like you and me.

Reasons Countries Levy Income Tax

Countries levy income tax on residents and citizens for several reasons. Some countries don’t have enough ways to generate a source of money for their daily work. Obviously, a working government needs to pay its own employees. Then, a government also needs to maintain roads and other infrastructure, have a good military to defend against foreign aggression and develop the country by providing attractive incentives to investors.

Here’re some of the main reasons why countries levy income tax:

- Revenue Generation: Income tax is a significant source of revenue for governments. It allows them to finance public expenditures, such as infrastructure development, education, healthcare, defence, social welfare programs, and other essential services. Income tax helps governments collect funds to meet the various needs of their citizens and invest in the overall development of the country.

- Redistribution of Wealth: Income tax is often used as a tool for wealth redistribution. By implementing a progressive tax system, where higher income earners are subject to higher tax rates, governments aim to reduce income inequality and promote social justice. The funds collected from higher-income individuals can be used to provide assistance & support to those with lower incomes through various social welfare programs, subsidies, and public services.

- Social and Economic Stability: Income tax helps maintain social and economic stability within a country. By collecting taxes, governments can finance public goods and services that are essential for the functioning of society. This includes maintaining law and order, infrastructure development, healthcare facilities, education systems, and more. These services contribute to a stable and productive society, benefiting all residents and citizens.

- Fiscal Policy and Economic Management: Income tax is a crucial tool for fiscal policy and economic management. Governments can use income tax rates and deductions to influence individuals’ spending and saving behaviour, stimulate or restrain economic growth, control inflation, and manage overall economic conditions. Tax policy can be adjusted to encourage investment, promote specific industries, or support economic recovery during recessions.

- Citizenship and Social Contract: Income tax is often seen as a civic duty and part of the social contract between citizens and the state. It represents an individual’s contribution to the country’s overall well-being and the provision of public services. By paying income tax, individuals show their commitment and support for their country, its governance, and the functioning of society as a whole.

It’s important to note that the specific reasons and motivations behind income tax can vary between countries and depend on their unique socio-economic and political contexts. Tax policies are influenced by a range of factors, including government priorities, public opinion, economic conditions, and historical and cultural factors.

Reasons Some Countries Have No Income Tax

There are several reasons why some countries do not charge income tax from their citizens and residents. These reasons can vary depending on the specific circumstances and priorities of each country. Here are a few common explanations:

- Resource-rich countries: Some countries with abundant natural resources, such as oil, gas, or minerals, may rely heavily on revenue generated from these resources. As a result, they may not impose income taxes on their citizens or residents because they have alternative sources of income to fund government operations.

- A low population and budget requirements: Countries with a relatively small population and low budget requirements may find alternative ways to generate revenue without relying on income taxes. For example, they may rely on revenue from other sources like tourism, exports, or foreign aid.

- Tax havens: Certain countries position themselves as tax havens, attracting individuals and businesses by offering low or no income tax rates. These jurisdictions often have favourable tax laws and regulations that encourage individuals and companies to establish residency or set up businesses within their borders. Tax havens aim to stimulate economic growth and attract investment by offering tax incentives.

- Social and economic policies: Some countries use tax policy as a tool to stimulate economic growth or encourage specific behaviours. For example, they may implement tax incentives to attract businesses, foster entrepreneurship, or promote investment in certain industries. By not charging income tax, these countries aim to attract skilled workers and investment capital, which can contribute to their overall economic development.

- Alternative tax systems: Some countries may have alternative tax systems in place, such as consumption taxes (e.g., value-added tax or sales tax) or revenue from state-owned enterprises. These countries may rely more heavily on indirect taxes rather than income taxes to fund public services and government operations.

It is important to note that the absence of income tax does not mean that citizens and residents of these countries are entirely exempt from taxation.

Governments often collect revenue through other means, such as indirect taxes, property taxes, corporate taxes, or social security contributions.

Additionally, the specific tax policies and regulations of each country can change over time as governments adapt to evolving economic, social, and political conditions.

What Do You Prefer?

So, what do you prefer? Do you prefer to live in a country that charges you income tax or in some place where income tax doesn’t exist directly but could be levied in some indirect form?

Actually, there’re some pros and cons of living in countries that levy income tax. At the same time, there’re pros and cons of living in countries that don’t charge income tax.

Here are some of the benefits of living in a country where you have to pay income tax.

Advantages of Living in Countries with Income Tax

Citizens benefit in several ways by paying income tax to their country. Here are some key benefits:

- Public Services and Infrastructure: Income tax is a significant source of revenue for the government, which is then allocated towards public services and infrastructure. These include education, healthcare, transportation, public safety, parks, and recreational facilities. By paying income tax, citizens contribute to the development and maintenance of these essential services, which benefit the entire society.

- Social Welfare Programs: Income tax helps fund social welfare programs aimed at supporting vulnerable populations such as the elderly, disabled, and low-income individuals. These programs may include welfare assistance, unemployment benefits, housing subsidies, and healthcare initiatives. Income tax ensures that the government can provide a safety net for those in need.

- Defence and Security: A portion of income tax is allocated to national defence and security. It helps fund the military, law enforcement agencies, and intelligence services. By contributing to income tax, citizens play a role in safeguarding their country and protecting it from external threats.

- Economic Development: Income tax revenue is often utilized to stimulate economic growth and development. Governments may invest in infrastructure projects, promote business initiatives, provide incentives for research and development, and support entrepreneurship. These efforts create job opportunities, attract investments, and foster a prosperous environment for citizens.

- Education and Research: Income tax supports educational institutions and research initiatives. By investing in education, governments can improve the quality of schools, universities, and vocational training programs. This enhances the knowledge and skills of the workforce, leading to better job prospects and economic growth. Additionally, income tax helps fund scientific research, which can lead to advancements in various fields and contribute to societal progress.

- Democratic Governance: Paying income tax is a civic duty that helps sustain the democratic governance system. It ensures that the government has the necessary resources to function effectively, maintain law and order, and provide essential services to citizens. By participating in the tax system, citizens contribute to the overall stability and functioning of their country’s democratic institutions.

In some places specific benefits citizens receive may vary depending on the country and its tax policies. Governments have the responsibility to allocate tax revenue efficiently and transparently to maximize the well-being of their citizens.

In India, for example, persons that pay income tax get an Income Tax Returns statement. This statement is useful for applying for visas for foreign countries, getting loans and mortgages for houses and other purposes.

Disadvantages of Paying Income Tax

While income tax is an essential component of a country’s revenue system, there can be certain perceived disadvantages associated with living in countries with income tax. Here are some common concerns:

- Financial Burden: Income tax can place a financial burden on individuals, especially those with higher incomes. High tax rates or a complex tax structure can lead to a significant portion of one’s earnings being deducted, reducing disposable income and potentially affecting their standard of living.

- Tax Complexity: Tax systems can be intricate and challenging to navigate. Understanding tax laws, deductions, and exemptions may require professional assistance, which can incur additional costs. Compliance with tax regulations can be time-consuming and burdensome for individuals and businesses.

- Inequity and Unfairness: Some argue that income tax can be unfair and inequitable. Progressive tax systems, which impose higher tax rates on higher-income individuals, aim to distribute the tax burden more equitably. However, critics contend that such systems can discourage productivity and incentivize tax avoidance strategies, leading to a perceived lack of fairness.

- Economic Impact: High-income tax rates can potentially discourage investment, entrepreneurship, and job creation. Individuals and businesses may be less motivated to work or invest in countries with high tax burdens, potentially impacting economic growth and competitiveness. Critics argue that lower taxes can stimulate economic activity and attract investments.

- Tax Evasion and Avoidance: High-income tax rates can lead to increased tax evasion and avoidance practices. Individuals and businesses may resort to illegal means to reduce their tax liabilities, resulting in lost revenue for the government. This can undermine the effectiveness and fairness of the tax system.

- Government Accountability and Efficiency: In countries with income tax, citizens expect their tax dollars to be utilized efficiently and transparently. However, concerns can arise about mismanagement, corruption, or wasteful spending by the government. A lack of accountability can erode public trust and confidence in the tax system.

It’s important to note that the disadvantages mentioned above are general concerns and may not apply uniformly to all countries. Additionally, income tax plays a crucial role in funding public services, infrastructure, and social welfare programs, which are essential for societal well-being. Governments strive to strike a balance between the benefits of income tax and addressing its potential drawbacks.

Advantages of Staying in Income Tax-Free Countries

Staying in income tax-free countries can offer several advantages to individuals. Here are some of the main benefits:

- Tax Savings: The most obvious advantage is that you can keep your entire income without having to pay any income tax. This allows you to retain a larger portion of your earnings, which can significantly increase your disposable income.

- Financial Freedom: Living in an income tax-free country can provide financial freedom and flexibility. You have the opportunity to save and invest more of your income, which can help you build wealth and achieve your financial goals faster.

- Business and Investment Opportunities: Income tax-free countries often attract entrepreneurs and investors because of the favourable tax environment. If you’re a business owner and looking to invest, you can benefit from lower operating costs, higher profitability, and more attractive investment options.

- Economic Stability: Income tax-free countries tend to have stable and robust economies. They often attract foreign direct investment, which contributes to job creation, infrastructure development, and overall economic growth. This stability can provide a favourable environment for career opportunities and financial security.

- An attraction for High-Income Professionals: Professionals with high incomes, such as executives, entrepreneurs, and skilled workers, may find income tax-free countries particularly appealing. They can retain a larger portion of their earnings, which can incentivize talent attraction and retention.

- Wealth Protection and Privacy: Some income tax-free countries offer strong legal frameworks that protect individual wealth and provide financial privacy. These jurisdictions often have strict regulations that safeguard personal and corporate assets, making them attractive for those concerned about asset protection and confidentiality.

- Quality of Life: Many income-tax-free countries are known for their high quality of life, offering excellent healthcare systems, education, infrastructure, and public services. Living in such countries can provide a comfortable and fulfilling lifestyle for individuals and families.

Usually, each income-tax-free country may have its own set of regulations, residency requirements, and limitations. It’s advisable to consult with legal and financial professionals to fully understand the implications and opportunities associated with living in a specific income tax-free jurisdiction.

Disadvantages of Living in No Income Tax Countries

While living in income tax-free countries may seem appealing, there are several potential disadvantages to consider:

- Limited Public Services: Countries that rely heavily on income tax revenue typically use it to fund essential public services such as healthcare, education, infrastructure, and social welfare programs. In income tax-free countries, these services may be limited or funded through alternative means, potentially resulting in reduced quality or accessibility.

- Higher Cost of Living: Income tax-free countries often compensate for the lack of tax revenue by imposing higher taxes or fees on other goods and services. This can lead to a higher cost of living, including increased prices for everyday necessities, housing, transportation, and entertainment.

- Inequality and Social Imbalance: The absence of income tax can contribute to a widening wealth gap and social inequality. Without progressive taxation, the burden of funding public services falls on other sources, such as consumption taxes, which tend to affect lower-income individuals disproportionately.

- Less Government Support: Income tax revenue is often utilized to provide government support and safety nets for citizens, including unemployment benefits, welfare programs, and social security. In income tax-free countries, the availability and effectiveness of such support systems may be reduced, potentially leaving individuals with limited assistance during challenging times.

- Reliance on Alternative Revenue Sources: To compensate for the lack of income tax revenue, countries may become heavily dependent on other revenue sources such as corporate taxes, import duties, or natural resource extraction. This reliance can make the economy vulnerable to fluctuations in those sectors, potentially leading to instability or an increased risk of economic downturns.

- Reduced Investment in Public Infrastructure: Without income tax revenue, governments may have limited funds available for infrastructure development and maintenance. This can result in inadequate transportation networks, public facilities, and utilities, potentially affecting the overall quality of life and economic competitiveness of a country.

- Challenges in Attracting Skilled Professionals: Income tax-free countries may face difficulties attracting skilled professionals who are accustomed to a certain level of public services and government support. The lack of income tax revenue may limit the availability and quality of healthcare, education, and other essential services, making it less appealing for professionals seeking a high standard of living.

Specific disadvantages can vary depending on the country and its overall economic and social policies.

Additionally, some income tax-free countries may have alternative mechanisms in place to mitigate these disadvantages, but they still need to address the challenges associated with funding public services and maintaining a balanced society.

30+ Income Tax Free Countries

Now you’re aware of the pros and cons of living in a taxation area as well as a non-taxation area. Not as a rule but in some countries, citizens can get more benefits than expatriates, though both don’t pay taxes.

This is most common in some countries of the Gulf Cooperation Council or GCC, which consists of six members- The state of Qatar, the Kingdom of Bahrain, the State of Kuwait, the United Arab Emirates, the Kingdom of Saudi Arabia and the Sultanate of Oman.

Therefore, living and working in some tax-free countries might not be worthwhile because you wouldn’t be able to enjoy a lot of rights.

However, if you’re interested, here’s a list of countries with no income tax. Obviously, there’re some countries you might not be interested in going to for work or staying. However, others are fairly hospitable. In yet a few countries, getting jobs and living is easy while in some, employment opportunities for foreigners don’t exist.

Sounds interesting? Read further.

1. Cayman Islands

Located about 500 miles off the southern coast of Florida, USA, this is a tax haven. The country consists of three islands, Grand Cayman, Little Cayman and Cayman Brac.

2. The Bahamas

This Caribbean country has no income tax and is also a tax haven. That’s why several multinationals show their headquarters as the Bahamas.

3. Bermuda

The infamous Bermuda Triangle gets its name from this country. Here too you have a large offshore banking industry while locals and foreign workers pay no personal taxes.

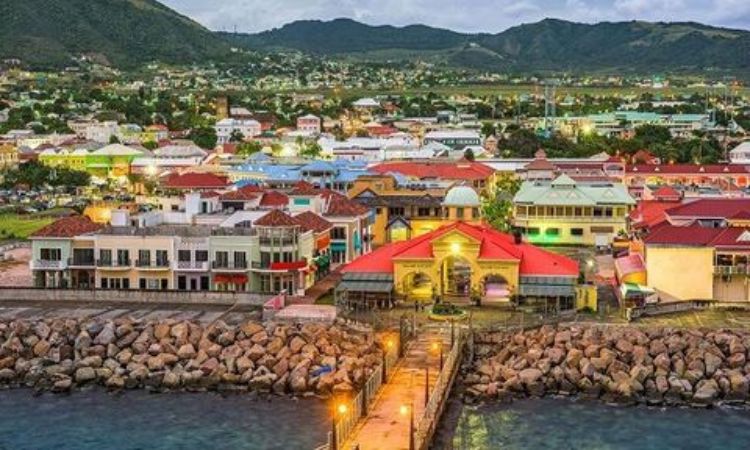

4. Kitts & Nevis

Maybe you haven’t heard of this country earlier. It is a small group of islands in the Caribbean and a famous stopover for cruises due to its scenic beauty and shopping. St. Kitts & Nevis doesn’t have a personal income tax.

5. United Arab Emirates

The United Arab Emirates is a country in the Arabian Desert of Asia. Known also as UAE, it is a union of seven separate emirates- Dubai, Abu Dhabi, Ras Al Khaimah, Ajman, Umm Al Quwain, Sharjah and Fujairah. The country is the hub of business in the Middle East, and the emirate of Dubai is a famous tourist destination. The UAE doesn’t have an income tax.

6. Sultanate of Oman

Perhaps the only colonial power from the Arab world, the Sultanate of Oman, once had colonies such as Zanzibar (now in Tanzania) and Baluchistan (now in Pakistan). The country is a merger of two kingdoms, Muscat and Oman and is governed now by a Sultan. The scenic country of Sultanate of Oman doesn’t levy income tax on citizens and ex-pat workers.

7. Panama

Standing at the crossroads of the world, especially North America and South America, the country Panama is known for its eponymous sea route, the Panama Canal that joins the Atlantic Ocean with the Pacific Ocean. This country is also a tax haven and hub for the registration of ships. Panama doesn’t levy income tax on individuals.

8. State of Kuwait

Despite the havoc on its oil resources wrought by the Iraqi invasion in 1991 and the Gulf War the same year, the State of Kuwait has a petrodollar-rich economy. Kuwait also has a small population, and the government spends part of its oil revenues on the welfare of both citizens and expat workers. Kuwait doesn’t levy income tax on individuals.

9. British Virgin Islands

British Virgin Islands is a territory of the UK. However, it enjoys a special status and is mainly home to a large British military base. The British Virgin Islands are also a top tourism destination. This island had no income tax for locals and foreign workers or soldiers.

10. Principality of Monaco

Many people describe the Principality of Monaco, located on Europe’s Mediterranean coast and to the south of France, as a sort of paradise. It is home to the largest number of millionaires and billionaires in the world. It has the lowest unemployment rates and provides jobs to persons from neighbouring France. The capital Monte Carlo is famous as a tourist destination.

11. State of Qatar

The State of Qatar, located in the northern Arab peninsula, was like an underdeveloped country till 1994, despite having the third largest reserves of natural gas in the world. This country doesn’t charge income tax. It has seen lots of progress and development during the reign of its erstwhile Emir, Sheikh Hamad Bin Khalifa Al Thani. The government of Qatar spends a lot on the welfare of both citizens and expats.

12. Kingdom of Saudi Arabia

The Kingdom of Saudi Arabia is home to two of the holiest sites of Islam, the Mecca and Medina. Saudi Arabia is also an oil-rich country and invests heavily in the development of its infrastructure and industry. In fact, Saudi Arabia is also developing as an industrial hub in the GCC region. Thanks to its wealth and position, there’s no income tax in KSA.

13. Kingdom of Bahrain

Bahrain means ‘two seas’ in Arabic. This country is located in the Arabian Gulf and is a large exporter of petroleum, though its resources have dwindled over the decades. However, the Kingdom of Bahrain is a business hub in its own right in the Middle East and also a superb tourism destination. The kingdom has never charged income tax from citizens and ex-pats.

14. Brunei Darussalam

Located in the Far East and adjoining Malaysia, the country Brunei Darussalam occupies most part of the Borneo islands. About 90 per cent of the income of Brunei Darussalam comes from oil and natural gas exports. The country is headed by a monarch who is also one of the richest people in the world. Brunei has no income tax, and you keep all the money earned.

15. Vanuatu

A small island nation in the Pacific Ocean, Vanuatu barely gets any tourists except curiosity seekers. The island doesn’t have much of an economy except for selling some fish, fruits and other stuff to nearby islands and Australia. The number of citizens of Vanuatu is so few that taxation doesn’t really make any difference. Hence Vanuatu is income tax-free.

More Income Tax Free Countries

Other than these 15 countries, here’re 15 more that don’t levy an income tax. Here’s a list of such other countries.

16. Hong Kong SAR

Once under the British crown, Hong Kong became a territory of the People’s Republic of China. However, as an international business hub in Asia, it offers the facilities of income tax waivers for both individuals and companies operating in the island state.

17. Maldives

The sole industry of Maldives is tourism and some assorted fisheries exports. Sadly, this country might cease to exist due to rising sea levels in the Indian Ocean. Hence, its few residents enjoy tax free salaries and other benefits.

Also Read: Top 10 Countries with Highest and Lowest Minimum Wage in the World

18. Nauru

Located close to Australia in the Oceania region of the world, Nauru is yet another island nation. The island is known for its tourism and postage stamps as well as other collectibles. The local population is very small and no expats work in Nauru. This country doesn’t levy an income tax.

19. Somalia

There’s no way to pay income tax in Somalia, even if you want. That’s because Somalia is a country torn by civil war, and there’s no government there. Sadly, this was once a prosperous country whose students could afford to travel abroad for studies. Decades of internal strife have left the Somalian economy in shambles, and the country has no real government as such.

20. Northern Mariana Islands

Part of US territories in the Pacific Ocean, the Northern Mariana Islands, is mainly of strategic interest to the US military. The Americans have a main base at Saipan, the capital of the Northern Mariana Islands. There’s a small indigenous population, too, with some working for the local agriculture, livestock and other minor industries.

21. French Polynesia

Tahiti is renowned worldwide as a leisure and pleasure destination, and in most cases, for adult tourism. As part of efforts to retain the charm of Tahiti and the rest of French Polynesia, the government in Paris has exempted locals and foreigners from paying income taxes.

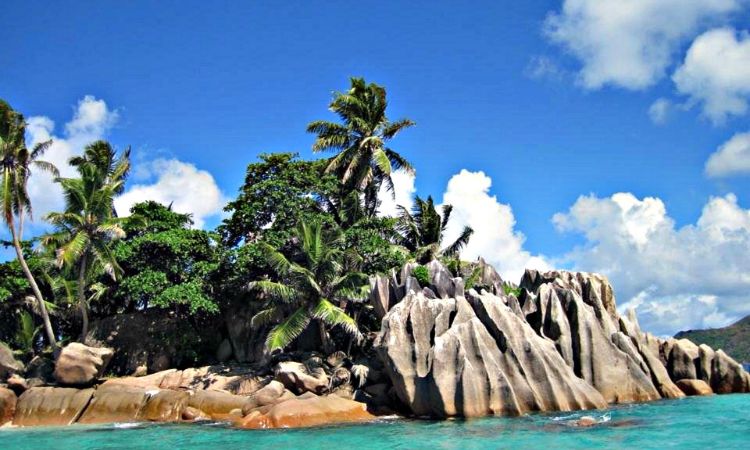

22. Seychelles

Another island state, Seychelles, has lots of fourth and fifth or even older-generation migrant populations from India and some from Africa. This country depends largely on tourism, fishing and watersport for its revenues. They also have a few assorted industries. The country invests its revenues in development and doesn’t tax residents or citizens directly.

23. Wallis and Futuna

Wallis and Futuna is a French overseas collectivity located in the South Pacific, known for its stunning volcanic landscapes, pristine beaches, and rich Polynesian culture.

24. Antigua and Barbuda

Antigua and Barbuda are a twin-island nation situated in the Eastern Caribbean, celebrated for its picturesque white-sand beaches, crystal-clear turquoise waters, and vibrant coral reefs, making it a popular destination for sun-seeking tourists and water sports enthusiasts.

25. Turks and Caicos

Turks and Caicos is an archipelago in the Atlantic Ocean, renowned for its breathtakingly beautiful beaches, world-class diving sites, and luxurious resorts, attracting travellers seeking a tranquil and upscale Caribbean getaway.

26. Barthelemy

St. Barthelemy, also known as St. Barts, is a chic Caribbean Island that offers a blend of French sophistication and laid-back island vibes. It is famous for its luxurious villas, upscale boutiques, and pristine beaches, making it a preferred destination for celebrities and discerning travellers.

27. Norfolk Islands

Located in the South Pacific Ocean, Norfolk Island is a small, self-governing territory of Australia. It is known for its stunning natural beauty, with picturesque landscapes, lush pine forests, and pristine beaches. Norfolk Island has a rich history, being first settled by Polynesians, later becoming a British penal colony, and now offering a unique blend of cultures. No income tax here.

28. Pitcairn Islands

The Pitcairn Islands are a remote group of four volcanic islands in the South Pacific, known for their isolation and rugged beauty. The islands are home to a small population of around 50 people, descended from the mutineers of HMS Bounty and their Tahitian companions. The Pitcairn Islands offer a serene environment, abundant marine life, and opportunities for eco-tourism, making them a destination for adventurous travellers. Nobody will charge income tax only to 50 citizens.

29. Vatican City

As the smallest independent state in the world, Vatican City is the spiritual and administrative headquarters of the Roman Catholic Church, located in Rome, Italy. It is home to iconic landmarks such as St. Peter’s Basilica, the Vatican Museums, and the Sistine Chapel, featuring Michelangelo’s famous frescoes. Vatican City holds immense cultural and historical significance, attracting millions of visitors each year who come to explore its religious treasures and architectural wonders. The clergy or Vatican citizens don’t pay income tax.

30. Anguilla

Anguilla, a British Overseas Territory, is a small island located in the Caribbean Sea. Known for its pristine white-sand beaches and crystal-clear turquoise waters, Anguilla is a popular destination for beach lovers and water sports enthusiasts. With a laid-back atmosphere, charming resorts, and a vibrant culinary scene, Anguilla offers a perfect blend of relaxation and indulgence. Citizens don’t pay taxes here.

31. Dominica

Dominica, also known as the “Nature Isle of the Caribbean,” is a volcanic island renowned for its lush rainforests, waterfalls, and natural hot springs. Home to the Morne Trois Pitons National Park, a UNESCO World Heritage Site, Dominica offers stunning hiking trails, including the famous Boiling Lake. Dominica’s commitment to sustainable tourism and its thriving ecotourism industry makes it an ideal destination for nature enthusiasts seeking an authentic and untouched Caribbean experience. All residents are exempted from paying income tax.

32. Curacao

Curacao, a constituent country of the Kingdom of the Netherlands, is a colourful island located in the southern Caribbean Sea. This vibrant destination is famous for its Dutch colonial architecture, stunning beaches, and world-class diving and snorkelling opportunities. With a rich cultural heritage, diverse cuisine, and a lively capital city, Willemstad, with its iconic pastel-coloured buildings, Curacao offers a unique blend of history, nature, and Caribbean charm.

Now you know where people live tax-free in the world or don’t pay income tax. Of course, in some of these countries, people pay indirect taxes such as import duties on essentials, Value Added Tax and other such levies.

Some countries don’t charge income tax due to relatively small populations. These are usually under the rule of some larger economies such as the US, France, the UK or Australia and hence their governments exempt residents of these territories from income tax.

Taxes on Foreign Income

Before you pack up to leave for a foreign land to avoid paying income tax, here’s something you should remember. A lot of countries, such as the US, charge income tax on salaries earned by working abroad, in some instances. Refer to the tax authorities whether your income abroad is taxable at home.

In some cases, such taxes are levied on the income you get by renting a house or real estate or other sources. Therefore, you might be working abroad but might still be liable to pay taxes in your home country. It’s always better to check with local tax authorities before embarking on such ventures to save taxes and work abroad.

Closing Thoughts

In my personal opinion, paying income tax always has certain benefits for ourselves and the country where we live. Countries such as the US and those in the European Union have some of the highest taxation levels in the world.

However, this income tax you pay also fetches you a lot of direct and indirect benefits. Taxation is one of the ways for a government to earn money for its own functioning and ensure the progress of citizens through various projects.

Olivia Carter is a versatile freelancer with expertise in finance-related writing, content creation, and consulting. With a Bachelor’s degree in Business Administration and a focus on Finance, Olivia brings a fresh perspective. Her adaptable writing style blends professionalism with approachability, engaging diverse audiences. Olivia explores personal finance, fintech trends, and enjoys literature and mindfulness.