Chances are you have already heard about Bitcoin but you don’t have a clear understanding of Bitcoin & what can you do with this. So today I will try to explain you everything in simple words.

What is Bitcoin?

In simple words, Bitcoin is paperless currency. Bitcoin lives on the Internet and can be used to buy and sell stuff online. Nobody prints or issues bitcoins like coins and notes. Nor does any bank or government control it.

Bitcoins are generated by computers worldwide. These very powerful computers are capable of solving complex mathematical problems and processing large volumes of data.

Computer experts describe the Bitcoin as ‘cryptographic currency’- meaning each unit is formed of a complex commands. These commands are written in computer programming language which cannot be decoded by common people.

Bitcoin was made some eight years ago and is known as the fastest growing currency of its kind.

How is Bitcoin different from regular currencies?

For one, bitcoins do not come in notes and coins as we know about the US Dollar, Euro, Yen or other regular currencies. But similar to regular currencies, the Bitcoin can be traded online.

It is now used by businesses and people to buy anything from bread and butter to gaming on online casinos. The biggest difference between a Bitcoin and regular currencies is that nobody controls it.

Bitcoin operates on its own system. It does not have a centralized control- meaning no individual or organization or country controls the Bitcoin network.

Why do people prefer Bitcoin?

Many people nowadays are worried about banks controlling their money and charging large service fees. Bitcoins do not require a bank or a financial institution. Anybody with a little knowledge of computers or using a good smart phone can hold bitcoins.

There are no service charges payable to anyone. People paying with bitcoins can select the amount they wish to pay as a transaction fee. Or they may choose not to pay the service charge altogether.

Since bitcoins operate in a highly secure cyberspace, the chances of your account or financial details being hacked and exploited are reduced considerably.

Who invented Bitcoin and how?

The idea of a paperless currency that does not require a bank or government control was the idea proposed in 1998 by a software programmer named Wei Dai.

Almost 10 years later, the idea was picked up and published in a software journal by another programmer called Satoshi Nakamoto, on October 31, 2008. Several people in the software business and finance industry liked the idea and created the Bitcoin.

What does Bitcoin mean?

The name ‘bitcoin’ is a mix of two common words ‘Bit’ and ‘Coin’. Here, the word ‘Bit’ stands for the measure used for computer data while ‘Coin’ is a common English word for metal currency.

The idea was to give a name that spoke about computer data and currency combined. Hence ‘Bitcoin’ was named.

Who makes bitcoins now and where?

As mentioned earlier, bitcoins are not made or printed in a mint like regular currency. People who buy and sell on the Internet have to send digital signals to one another.

Bitcoin does this using its own open source software. This means that anyone can join and view the software and the process, provided they are well equipped for the process.

What are the advantages of Bitcoin over conventional currency?

Banks worldwide have assumed immense powers over currency trading. They now reserve the right to deny banking rights or use of the banking network to individuals and companies.

For example, a bank can deny honouring a person’s credit or debit card, refuse to honor a cheque and at worst, freeze bank accounts. Bitcoins operate independent of any banking network and hence, the right to accessing your assets can never be denied.

A truly international currency:

Bitcoin can be called the world’s first international currency since it does not belong to any government. It can be bought or sold regardless of any restrictions imposed by any country.

This can be useful in remitting cash to nations where specific currencies are not permitted for trade. You do not need to submit your personal details such as passport, identity cards or any other document to buy and sell bitcoins.

In brief, Bitcoin does not discriminate between nationalities and every buyer enjoys the same rights.

Bitcoin is unaffected by inflation and hyperinflation:

Countries nowadays are increasingly abandoning the gold standard or collaterals used to guarantee their currencies. Thus most regular currencies issued nowadays are classified as ‘Fiat Currencies’ meaning a government can issue as many notes as it likes to counter any emergencies.

Governments and their apex banks can also create artificial shortage of their currency by making it extinct. This sends the price of a currency soaring high. As Bitcoin is decentralized, nobody can issue more of them or reduce the number in circulation.

Bitcoin help development of under developed parts of the world

Any person with access to Internet on a smart phone in an under developed part of the world can buy and sell bitcoins or purchase essential commodities. Since there are no regulators for bitcoin, nobody has the right to shut it down. Large amounts of bitcoins can be carried to any part of the world.

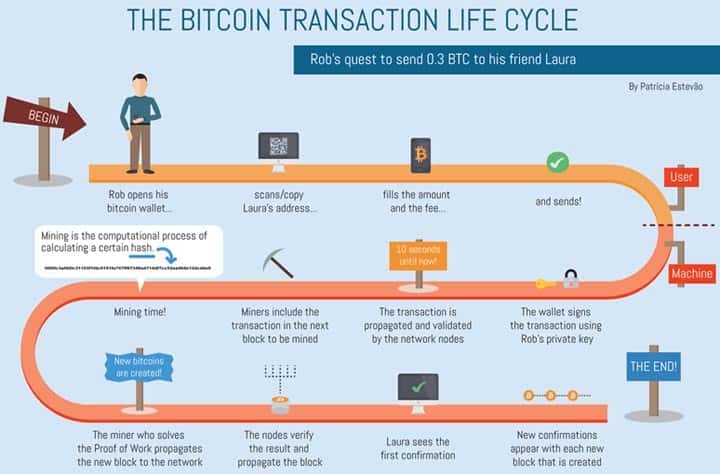

What are the processes involved in Bitcoin trading?

Whenever you send a Bitcoin to buy something, a complex chain of computer signals are generated. These are called ‘blocks’. Individuals or a group of persons worldwide monitor the network for Bitcoin transactions.

Individuals or groups scan the Internet data for Bitcoin transactions. They bundle these transactions into ‘blocks.’ These block are dispatched on a further journey. The ‘block’ of transactions recorded consecutively travels on what is called as a ‘blockline’.

These blocklines are monitored worldwide on computers. Records of each block are maintained online. This book keeping process helps prevent frauds and misuses of bitcoins.

Who monitors the transactions and the processes?

Individuals who scan the bitcoin network for payments, record the transactions, create blocks and dispatch them further are called miners.

Anyone with proper computer skills and knowledge about the Bitcoin system can become a miner. To mine bitcoins, they require powerful computers that contain the Bitcoin open source software.

What do miners get for their efforts?

High powered computers used by miners consume large amount of electricity. They also put in physical efforts to create blocks and monitor the blockline.

Their efforts are rewarded in the form of new bitcoins. The new bitcoins paid to miners are generated by computers connected to the distributed bitcoin payment network. These bitcoins are credited into the electronic wallets of miners.

But does the system not generate millions of bitcoins?

No. The Bitcoin system is programmed to generate only a few bitcoins daily. In about one hour, only 12.5 new bitcoins are produced by the network. New bitcoins are created only when miners detect or mine a transaction and process it.

Further, there are only 13 million bitcoins in circulation worldwide. The system is designed to generate only 21 million bitcoins totally and that figure is expected to be achieved after several years only.

Since the supply of bitcoins is fixed and pre determined, there are no chances of it being used for speculation.

Can I become a Bitcoin millionaire?

Strictly speaking, the Bitcoin system does not permit speculation. Meaning you cannot buy a large number of bitcoins and hoard them for sale when the prices are high.

Bitcoin prices have definitely risen exponentially over the last few years. But you would need to block a considerable fortune in bitcoins now, hoard them and sell when prices go through the roof.

Why use bitcoins instead of USD, Euros, Yen & other regular currencies?

Only 13 million bitcoins exist worldwide till date and new ones are created in limited numbers. This prevents speculators from buying large numbers of bitcoins or offloading them in the market. Reckless trading is thus prevented and the price of a Bitcoin remains somewhat stable.

In contrast, speculators can buy large amounts of regular currencies creating an artificial demand in the currency market. This tends to send the prices of dollars and Euros, Pound Sterling and Yen soaring.

Any wild swing in the rates of major currencies affects the common man adversely as market prices for food, fuel and other essentials also rises.

What is the price of one Bitcoin?

Way back in 2008, one Bitcoin cost a mere US$1. People were hesitant to buy the Bitcoin. Over the years, Bitcoin became popular and the demand rose sharply. This caused an increase in the price of the Bitcoin.

Usually a single Bitcoin would cost you anything between US$800 to US$1,150. But on March 2, 2017, the demand for Bitcoin rose sharply. That day, the Bitcoin became more expensive than an ounce or pure gold and traded at US$ 1,280 each. But prices have dropped since then.

How does one decide the value of a Bitcoin?

Regular currencies get their value from gold, silver, crude, derivatives and other tangible financial assets held by a government. The Bitcoin is based on mathematical calculations.

Miners, Bitcoin exchange houses and other parties use a special software program to regulate this digital currency. The software works on complex mathematical calculations to churn out new bitcoins.

This formula is not a state secret and anyone can access it. This open source software keeps the system free from frauds and transparent for Bitcoin users.

What are the important features of Bitcoin that I should know?

No controlling authority:

Bitcoin has several unique features that set it apart from regular currencies. As discussed earlier, the Bitcoin network and digital currency is not controlled by any government or bank. No single individual or group can claim to control Bitcoin.

This means, it is a completely decentralized currency, free from all government or bank or individual control. Any change in the government or crises worldwide affects regular currencies. Bitcoin however remains largely unaffected.

Ease of buying and selling:

It is easy to buy, sell or trade in bitcoins. All you need to do is visit the website of any reputed financial house that deals in bitcoins.

These financial houses offer easy setting up of a Bitcoin trading account. Conventional banks ask for several documents including proof of identity and address before opening an account. For Bitcoin accounts, you do not require any complex documentation.

You can either use bitcoins for online purchases or sell them for cash at any of the exchanges that offer the facility.

A growing ATM network:

The years 2015 and 2016 witnessed a boom in Bitcoin demand and trading. Encouraged by this demand, Barclays Bank in the UK and financial institutions in the US began installing Automated Transaction Modules (ATMs) specifically for the Bitcoin customer.

Barclays began by accepting bitcoins as donations to charities. In the US, people can buy bitcoins through ATMs. Some 800 Bitcoin ATMs are functioning worldwide of which over 60 percent are located in the US.

Do I need to pay taxes on bitcoins?

No. All Bitcoin accounts are anonymous. Your name and physical address will not be linked to your Bitcoin account. You will be identified only as a Bitcoin user. This also allows you to hold several Bitcoin accounts.

You can buy and sell bitcoins through these financial institutions. Since service fees and commissions are not fixed, you can decide how much you wish to pay while buying, selling or transferring bitcoins. Or, you need not pay at all.

How safe is the Bitcoin system?

It is very safe. Each transaction is carefully monitored, recorded and digitally documented through the blockchain. This blockchain also serves as a giant ledger. Anyone can check how many bitcoins are held by an entity. But the identity of the Bitcoin holder remains completely anonymous.

Since the blockchain is closely monitored by people who do not trust one another, chances of a fraud or wrong transaction are almost completely eliminated.

24 x 7 x 365 access:

The Bitcoin network does not enjoy holidays like banks and governments. It is operational round the clock daily, for all days of the year. It is easily accessible from any part of the world.

How do I access my bitcoins:

Bitcoins are only a piece of data. Hence, they are stored on software wallets, special hardware which serves as wallets, software provided by exchange houses that function from smart phones or other mobile and digital wallets that can be installed easily on a PC or laptop.

Only you can access your digital wallet by using a series of highly encrypted passwords. Transaction details are usually sent by the network to your wallet, alerting you of a debit or credit.

There are an estimated eight million users worldwide who own a Bitcoin wallet.

Do I need to spend an entire Bitcoin for a transaction?

No. Bitcoin also has smaller denominations that are used as ‘change’. Bitcoin is the only currency that can be divided to its millionth part. The smaller units of a Bitcoin are called Satoshi, in memory of its founder. Satoshis come in denomination of 1/1,000 Bitcoin and 1/ 10,000,000 Bitcoin.

What are the flip sides of a Bitcoin?

Several scammers have tried to cheat Bitcoin holders. They do so using malware hidden in electronic wallets provided by dubious sources. Some bogus exchange houses offer a high rate for your bitcoins.

But when you transfer them for cash, these exchange houses simply vanish. Individuals have also tried to cheat Bitcoin users into disclosing their personal bank and other financial details.

How to claim a refund for lost bitcoins?

It is very difficult to lose bitcoins. You can lose your bitcoins only if you fall prey to fraud or misplace your digital wallet hardware, software, access codes and digital signature. If this happens, there is no way to reclaim your lost bitcoins.

The encouraging news is, several corporate giants including Microsoft, Dell, Expedia are now accepting Bitcoin as payments. Currently, some 60,000 merchants spread across 40 countries accept Bitcoin as tender for purchases and sales.

Listed below are some resources for existing and prospective bitcoin users.

Resource:- Bitcoin.com

Wallets:- CoinBase & Bitcoin.org

Payment Processor:- BitPay

Exchange:- BuyBitcoinWorldwide

Bitcoin Wiki:- Bitcoin.it

Merchant:- 99 Bitcoins.com

I hope you have got sufficient knowledge of Bitcoin after reading this article & you are in a position to decide what you can do with this.

And if you are planning to get involved or invest in Bitcoin, you are advised to check details with an expert and government authorities·

Pritam Nagrale, a digital marketer and Generative AI enthusiast, embarked on his journey with affiliate marketing in 2004. With over 14 years of blogging, he has turned his passion into a fortune, profoundly impacting the digital landscape. Through his expertise, Pritam has guided thousands to monetize online and achieve their dreams, establishing himself as a beacon for aspiring digital entrepreneurs.